Submitted by Merri Ann Simonson

Coldwell Banker San Juan Islands Inc

If you are contemplating buying a rental investment on-island, one of the Roche Harbor Resort homes or parcels should be on the list for consideration. In 2005, I purchased a two-bedroom rental house in the resort and have been very pleased with my investment.

I believe that the properties in the resort and nearby fared better through the recession. On San Juan Island, our prices peaked in 2007 and reached the floor in 2013. During that period our median home price decreased 30 percent. We have recovered since then and, in some pricing categories of our market, we may soon be able to measure appreciation. As a realtor, I have noted that homes and parcels in and near the resort sell at a higher percentage over their tax assessment than other homes on the island. As an example, I paid $534,000 for the two-bedroom rental home in 2005. If I add two additional years of average appreciation of 6 percent for 2006 and 2007, then calculate the 30 percent discount to market value due to the recession years, my house should be worth around $425,000 today, which is not the case. I recently had my home appraised and the value issued was $675,000. I can personally say that Roche Harbor properties hold their value in tough years.

The resort hosted more than 105 weddings in 2016 and the majority of the wedding party and their guest stay at the resort in the rental homes, the hotel and other suites that the resort offers. Most of the families prefer to stay in the rental homes, as they accommodate a larger group to include grandma and pa and the rest of the family. The homes offer outdoor entertaining areas and are more cost effective when you consider the nightly rental rate is divided up by the number of couples staying in the house. This year larger homes have been the most popular in the rental pool.

The resort is also growing the shoulder season with various events such as sail boat races, boat club rendezvous, fishing derbies, and offering getaway packages at off-season rates. They also attract companies looking for a retreat out of the city, family reunions, photography workshops and bicycle tour groups. In addition, they host an Irish music festival in the spring, church retreats and bird watching groups. Locals and visitors alike enjoy the very popular Island Stage Left, which is at the outdoor theater.

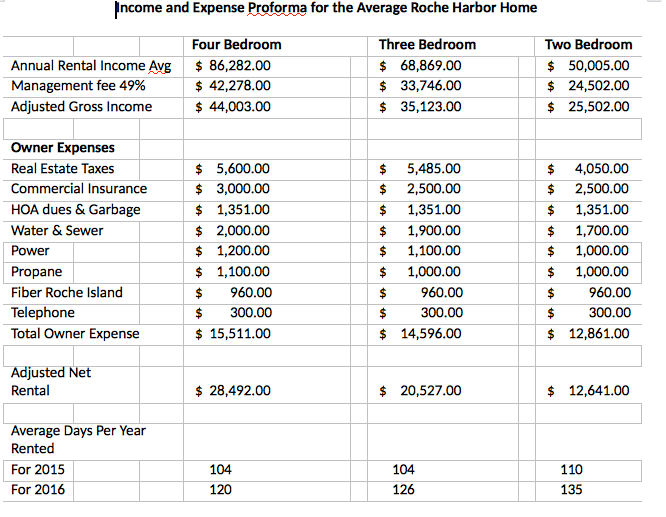

Occupancy has been increasing steadily since 2005; however, will vary annually based on the amount of similar homes that are available for rent at the resort. For average occupancy days, see the table above.

Rental Pool

In the resort 50 percent of the existing homes are in the rental pool, the balance of the homes are primary residences or second homes. The rental pool generates a good income for the homes and is similar to the operation of a Vacation Rental By Owner, with Roche Harbor handling all of the reservations, website, light maintenance and cleaning. Their management structure is similar to a hotel with nightly cleaning if requested. They also stock the kitchen with dinnerware, glasses and small appliances, so that the items that are damaged can quickly be replaced with matching equipment and they provide all linen. The property management team at the resort does a very good job of providing a high level of customer service. They offer the least amount of owner involvement in the management as compared to other property management firms on the island.

The owner may remove the home from the rental pool at any time for owner use with notice and payment of the cleaning fee. Of course, heavy owner use will have an impact on the net operating income.

Below is an outline of the income and expense proforma for each type of home in the rental pool. Roche Harbor charges a 49 percent management fee as the homes are operated very similar to a hotel. Utilities are similar to any other home on the north end, but if the home is in the rental pool, as in the case of any vacation rental, commercial insurance is required, which is more expensive.

At the resort the occupancy of the homes is more consistent than those homes offered via VRBO, owner managed or those with the private management firms on the island. The resort creates occupancy versus only responding to inquiries on their website, as well as they have many return clients for the various events.

The homes in the resort enjoy all of the resort benefits including access to the pool, boat launch, and tennis courts and convenience to the marina, restaurants, retail shopping and spa.

Zoning

The resort zoning is designated as a master planned resort with the intended use of nightly occupancy at the marina and in the residential units at the resort as well as a wide range of commercial activities. This zoning insulates an investor from any changes or challenges that the county or state may create to regulate the VRBO, Airbnb and/or B&B industries.

Financing

If you intend to buy an existing home and use it as a primary residence or second home, conforming financing is available at your favorite institutional lender. If you intend to place the home into the rental pool, then you need to seek out a portfolio lender and may need to secure a loan based on the income produced. A portfolio loan is typically slightly higher in rate and may be fixed for 3-5 years but then may adjust annually. These terms are set by the bank as these loans are not sold into the secondary market to FHLMC or FNMA.

The income property loan will require a debt service ratio of at least l00%, if not more, subject to your overall package. Basically, the property must be able to service all of the expense and debt without requiring owner contributions. The property and the income flow are the collateral for the loan. This equates to a lower loan-to-value ratio than a conforming loan, most likely under 50 percent.

I used my self-directed IRA to purchase my investment along with a non-recourse loan to the LLC that holds title to the house. I personally partnered with my IRA to purchase the property which allows me to management the LLC and associated bank account versus having to pay a custodian which would have been normally required due to the IRA involvement.

If you are just interested buying a parcel, seller financing is available for short-term; under five years at 5 percent with 25 percent down. This type of loan is a bridge allowing a property owner to contract with their development team and arrange for a construction loan and secure permits. Once the construction loan is ready to proceed, those funds are used to pay off Roche Harbor’s loan.

Just in case you guessed, I am a recovering lender. I worked in the banking industry for 19 years before coming to my senses and becoming a realtor on San Juan.

Parcel Sales

The lot sales in 2016 and 2015 were very strong with most of the higher-end lots selling. Several of the homes sites are now under construction and several have plans to start in the near future. As the high-end homes are built along the ridge, the resort will have more depth and diversification. The listing prices for the lots include water and sewer hookup fees with telephone, power and fiber in the road.

Home Design

Roche Harbor has a pattern book, which establishes the image and character of the houses designed within the various neighborhoods of the community. The pattern book assures the scale, details and continuity of style throughout the overall Roche Village. The pattern book outlines the setbacks and site conditions that control the maximum square footage size of the home; there is no minimum home size.

What you decide for your interior floor plan, as long as it is within the framework of the pattern book, is completely up to you. If you intend to submit the home into the rental pool, the Roche Harbor Property Management staff and their realtor are available to consult on efficient and effective floor plans.

The Roche Harbor town architect works with the owner, architect, designer and contractor in monitoring the design process for compliance with the pattern book throughout the design and construction process. To ease this process, the team has several checklists to aid in compliance and communication.

If you plan to construct a rental house in the resort, you should budget $275-300 per foot for the cost to construct, although several homes in the resort have exceeded that range. In addition, you need to have a budget for landscaping, furniture and personal property that meets the expectations of a high-end rental client.

Disclosure

As you may be aware, I am also Roche Harbor’s realtor, but I write this article with my personal experience in owning one of the homes since conception and proudly recommending this type of investment. I feel very confident in the future of the resort, so much that I purchased a lot and plan to build another rental investment in the next few years.

As always, I must disclose that the proforma above is only a summary of the average of the income and expense associated with the rental of a two, three or four bedroom home in the Village. Actual gross income will depend on numerous variables, including size of home, location, season and the economy. Net income is also dependent upon variables such as mortgage amount, interest rate, taxes, maintenance and utility costs. Maintenance for the home and landscaping expenses vary and should be considered as well. This proforma is not intended to be a pledge or promise of net income from the placement of a home in the rental pool.

There are numerous parcels listed for sale as well as several resales of existing homes. See the links below for more details.

Contact Merri Ann Simonson, Coldwell Banker San Juan Islands Inc., at simonson@sanjuanislands.com or 317-8668.

Link to Roche Harbor Questions and Answers Form: http://www.sanjuanislands.com/PDF/RocheHarborQA.pdf

Link to Homes and Lots currently listed at the resort: http://www.matrix.nwmls.com/DE.asp?k=2966929XWCWZ&p=DE-70345492-997